Climate Finance Roundup - December 2

Data center operators issue green bonds; Funding for copper cathodes; Sustainable loan for water treatment; Public-private financing for transmission infrastructure; Decarbonizing homes in the UK

In this newsletter

European banks - Green assets and AI adoption

News

Recent Sustainable Bond Issues

Why is Climate Tech underfunded?

Public-private financing for transmission infrastructure in California

UK government-backed pilot to decarbonize homes

European banks - Green assets and AI adoption

The European Banking Authority's November 2024 Risk Assessment Report reveals developments in the EU/EEA banking sector. Banks have expanded their asset base to EUR 27.9 trillion with a 1.2% growth rate (upto June 2024), while maintaining strong capital positions with CET1 ratio reaching 16.1%.

The report highlights several key challenges including

increased direct exposure to geopolitical risks - EUR 500 billion as of June 2024

significant NBFI exposure (9.8% of total assets)

increased cyber threats and growing operational risks with losses reaching EUR 17.5 billion

As per the report, the banking sector's green transition remains modest with total GAR (Green Asset Ratio) below 3% at the end of 2023. Banks have started offering more sustainable lending products, mainly for large corporates.

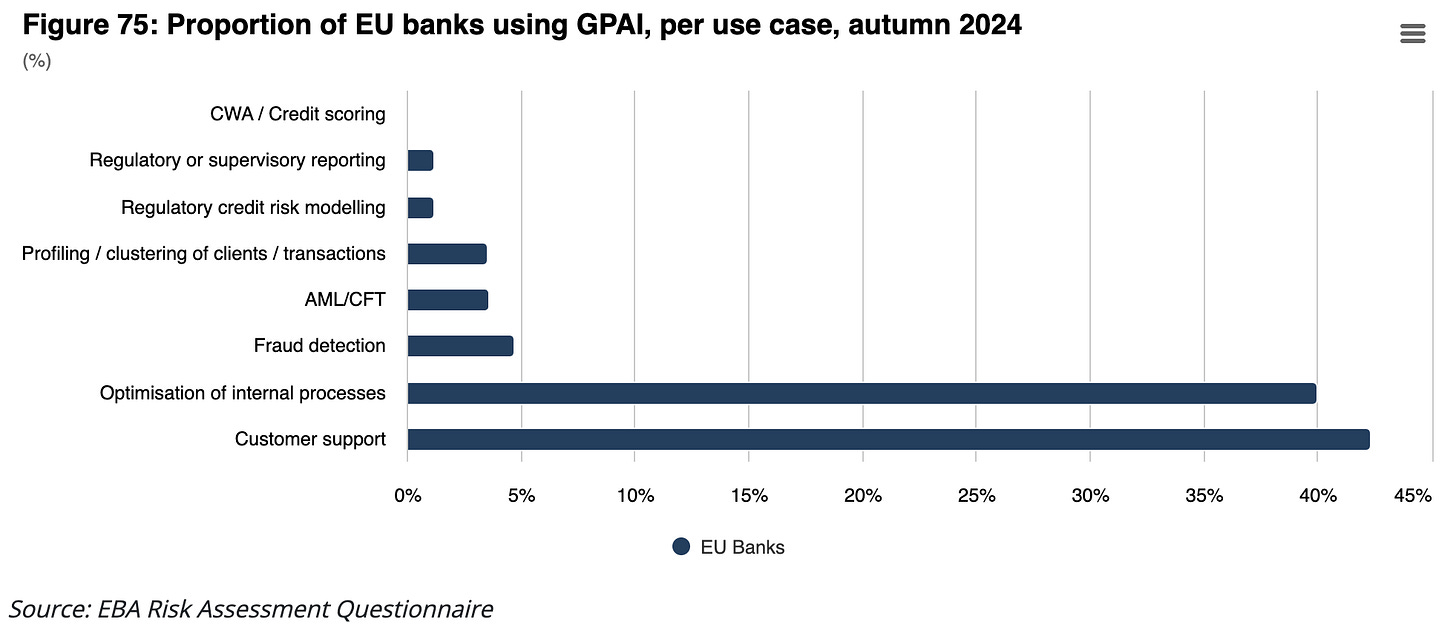

The report also highlights the use of AI in the European Banking Sector

AI is most frequently employed in areas such as client and transaction profiling (for commercial purposes) and customer support

…AI plays a role in fraud and AML/CFT efforts, where it is used to analyse vast amounts of data and detect patterns indicative of illicit activities. Beyond these prevalent applications, AI is also increasingly used to optimise internal processes within banks, in credit scoring and creditworthiness assessments, and in regulatory credit risk modelling. While most of EU banks are leveraging AI in these areas, there are other use cases where AI adoption is less widespread, such as supervisory reporting, monitoring conduct risk, real estate valuation or carbon footprint estimation.

The major change over the past 2 years is that most banks have moved from AI system pilots, to using AI in production. Nearly 40% of EU banks are also experimenting with General-Purpose AI (GPAI) for customer service, call centres, programming & coding and legal analysis.

But the EBA finds that there are limited tools for consumer protection in using GPAI. In terms of investment, over 50% of surveyed banks plan to invest between 0-0.25% of their equity in GPAI, while 21% plan to invest above 0.25%. Most banks are adopting a multi-modal approach to GPAI deployment, typically using 1-3 different approaches combining third-party services, cloud APIs, and open-source models.

Sign up to read more

Telborg sends you a daily newsletter with global developments in Climate Finance and Carbon Markets. We write succinct summaries, with sufficient detail, in the newsletter itself, so that visiting the links provided is optional.

Why do we do this

Opening links and switching tabs is distracting. One of the joys of reading a good book is that the context you need to understand it is provided to you within that text. You can augment your experience of reading it by using the internet alongside, but that is not necessary. At Telborg, we write to hold your attention with interesting ideas.

Verbosity is annoying. Most news developments can be communicated well in simple language and a few sentences.

News needs to be about what has occurred. Opinions are distinct from actual events. Some opinions are insightful, but need to be presented clearly as opinions, not as fillers in a sparse news feed.

Reading connected news items together is better for tuning your mental models. Most people are yet to experience this, because existing topical newsletters do not filter the news well and do not cover enough geographies for a topic. We expend great effort to address both.

Search is the wrong way to do research. There are excellent search engines - old and new, but research is about finding what you didn’t know what you were looking for. About discovering something delightfully interesting and relevant. And by definition, you don’t know what the search query for that is.

We promise simple, useful and interesting reporting 5 times a week.

You can signup for $50 a month or $500 a year.

Here’s an unlocked premium post

News

The European Investment Bank (EIB) has made several funding announcements

A €30 million loan agreement with Spain-based Cunext to finance construction of a copper cathode manufacturing plant in Córdoba. The facility will use electrolytic refinement technology to produce high-purity copper cathodes from recycled materials, reducing the need for primary copper mining. The project, backed by the InvestEU programme, will create jobs in a cohesion region while supporting EU's circular economy goals and strategic autonomy in raw materials.

A €400 million loan to Czech energy utility ČEZ to upgrade and expand the country's electricity distribution grid. The project will enable integration of up to 5.5 gigawatts of new renewable energy sources and is scheduled for completion in 2026. This follows a previous €790 million EIB loan to ČEZ in 2022, bringing total EIB funding to ČEZ to nearly €2.8 billion for green electric supply and generation projects in the Czech Republic.

A €350 million loan to Czech bank Ceskoslovenska Obchodni Banka (CSOB) to support business financing in the Czech Republic. A portion of the funding will focus on climate action and environmental sustainability, including energy efficiency in manufacturing and agriculture, clean transport, and renewable energy projects, with particular emphasis on underdeveloped 'cohesion' regions in the country.

€400 million in loans to two Czech financial institutions - Komerční banka and SG Equipment Finance Czech Republic (SGEF), with €200 million allocated to each. The funding aims to support SMEs and Mid-Cap companies in the Czech Republic and Slovakia, with over 90% of financing targeted at less developed areas. Part of the funding is specifically allocated for climate action and environmental sustainability projects, including renewable energy and energy efficiency initiatives in transport, buildings and machinery.

A €160 million financial package to support Serbian businesses through a partnership between EIB Global and Banca Intesa/Intesa Leasing. The funding will support around 240 companies and protect approximately 25,000 jobs, focusing on SMEs and mid-caps for working capital, investment needs, and green investments in renewable energy, clean transportation and energy efficiency projects. The initiative is part of the EU for Green Agenda in Serbia and includes technical assistance to help Serbian SMEs develop green investment projects.

A €150 million guarantee to Portuguese bank Caixa Geral de Depósitos (CGD) to boost financing for strategic industrial sectors in Portugal. The guarantee is expected to mobilize new investments of up to €420 million, providing mid-caps and public entities with lower interest rates, higher financing volumes and reduced collateral requirements. The initiative is part of the 'LRS-EU LE Risk Sharing Instrument' program aimed at ensuring better access to financial resources for beneficiaries.

Luxembourg's Commission de Surveillance du Secteur Financier (CSSF) has imposed a €56,500 administrative fine on Aviva Investors Luxembourg S.A. following a thematic ESG-focused on-site inspection conducted between October 2022 and May 2023. The investigation revealed breaches in sustainability-focused sub-funds of the Fund:

one sub-fund included bonds, representing 5.5% of net assets, that did not meet the ESG score threshold defined in the Pre-Contractual Disclosures

As per CSSF, adequate measure were not taken to ensure that the sub-funds would meet the target Sustainable Development Goals outlined in the fund prospectus

UK-based BDO LLP has been granted Approved Verifier status under the Climate Bonds Certification Scheme. It can now “provide third-party assurance to issuers seeking Climate Bonds Certification, evaluating projects and assets across multiple green sectors to ensure they meet the rigorous environmental and technical standards defined under the scheme.”

Royal Bank of Canada's RBC Foundation has announced $9.3 million in multi and single year grants through its newly launched Community Infrastructure Fund to support capital projects aimed at reducing environmental impact and improving accessibility in public spaces across Canada. The fund, first piloted in April 2024, provides support for retrofits, repairs, upgrades to existing public community buildings, and construction of new public spaces. The grants have been distributed to multiple organizations across Canadian provinces including a $1 million grant to the Glenbow Museum in Alberta, $1.5 million to Ottawa Public Library, and $800,000 to Westpark in Toronto. The funding focuses on two key objectives: environmental sustainability improvements and enhancing physical accessibility in community spaces.

Barbados has launched the world's first debt-for-climate-resilience operation, generating US$125 million in fiscal savings to finance water and sewage projects resilient to climate change. The deal involves a Sustainability Linked Loan backed by US$300 million in guarantees, US$150 million each from the Inter-American Development Bank and the European Investment Bank (EIB), while the IDB and Green Climate Fund are providing US$110 million upfront funding, including a US$40 million GCF grant. The funds will be used to upgrade the South Coast sewage treatment plant into a modern water reclamation facility.

The sustainability targets underpinning the loan relate to the volume and quality of reclaimed water generated by the upgraded plant. If the targets are not met, the government incurs a financial penalty, which will be paid into a specialized trust for environmental investments, the Barbados Environmental Sustainability Fund.

The Monetary Authority of Singapore (MAS) has revised the Code on Collective Investment Schemes to rationalize leverage requirements for REITs. The new rules implement a minimum interest coverage ratio of 1.5 times and a single aggregate leverage limit of 50% for all REITs applicable from the date of announcement. This is lower than the previous requirement of 2.5 times ICR for REITs seeking to increase leverage from 45% to 50%. The changes also mandate additional financial disclosures for financial periods ending on or after March 31, 2025, including sensitivity analyses and management plans when ICR falls below 1.8 times.

Recent sustainable bonds issues

Climate Bonds Initiative has published Sustainable debt market Summary Q3 2024. As per the report, the global GSS+ (green, social, sustainability and sustainability-linked) debt market has reached USD 5.4 trillion in Q3 2024, with social volumes breaking through USD 1.1 trillion (cumulative) and sustainability volumes reaching USD 956.4 billion.

Compared to 2023, year-to-date aligned GSS+ bonds have increased 11% to USD 818.2 billion. Highlights:

The Dominican Republic has launched its debut sovereign green bond worth USD 750 million maturing in 2036, following the publication of its Green, Social and Sustainability Bond Framework. The proceeds will support climate change mitigation and adaptation projects including low-carbon transport, renewable energy incentives, and water management.

European Investment Bank (EIB) made two issuances USD 4 billion in July, and EUR 5 billion in August. The latter saw a demand of EUR 34.5 billion, nearly 7x the issue size

Data center operators were involved in green bond issuances - US-based Stack Infrastructure has issued a USD 3 billion green loan in August 2024, while Texas-based Digital Realty Trust Inc. has priced a USD 942 million nine-year green bond through its subsidiary Digital Dutch Finco BV in September. The funds will support development of environmentally sustainable data centers in Arizona, Georgia, and Virginia.

French retailer Carrefour SA and German electronics retailer Ceconomy AG have entered the sustainability-linked bond market with EUR 750 million and EUR 500 million issuances respectively. Ceconomy's bond includes targets for reducing scope 3 emissions by 14.8% by September 2027.

Major tech companies are advancing clean energy initiatives, with Microsoft signing an 835MW nuclear power purchase agreement with Constellation Energy to power its data centers. This follows Constellation Energy's USD900m green bond issuance in March 2024 for nuclear energy projects.

Why is Climate Tech underfunded?

A new whitepaper from Resonance Asset Management analyses the funding gap in the climate tech space. As per the paper, global climate technology companies have experienced a significant decline in late-stage funding during 2022-2023, with Series C volumes falling by 35% and growth investments dropping by 41%. The analysis reveals that only 20% of the $270 billion private capital raised between 2017 and 2022 for energy transition was allocated to late-stage venture and growth-focused funds.

The report identifies two critical funding gaps affecting climate tech startups:

the Technology Valley of Death (concept to prototype stage) and

the Commercialization Valley of Death (prototype to market stage).

Major barriers to capital flow identified are - insufficient government support, short-term investment horizons of PE funds, lack of sector expertise among tech VCs, uncertain markets and competition from conventional fossil-fuel based technologies.

The paper also highlights a structural misalignment between venture capital preferences and climate tech characteristics, as climate tech typically requires longer-term, capital-intensive investments.

Public-private financing for transmission infrastructure in California

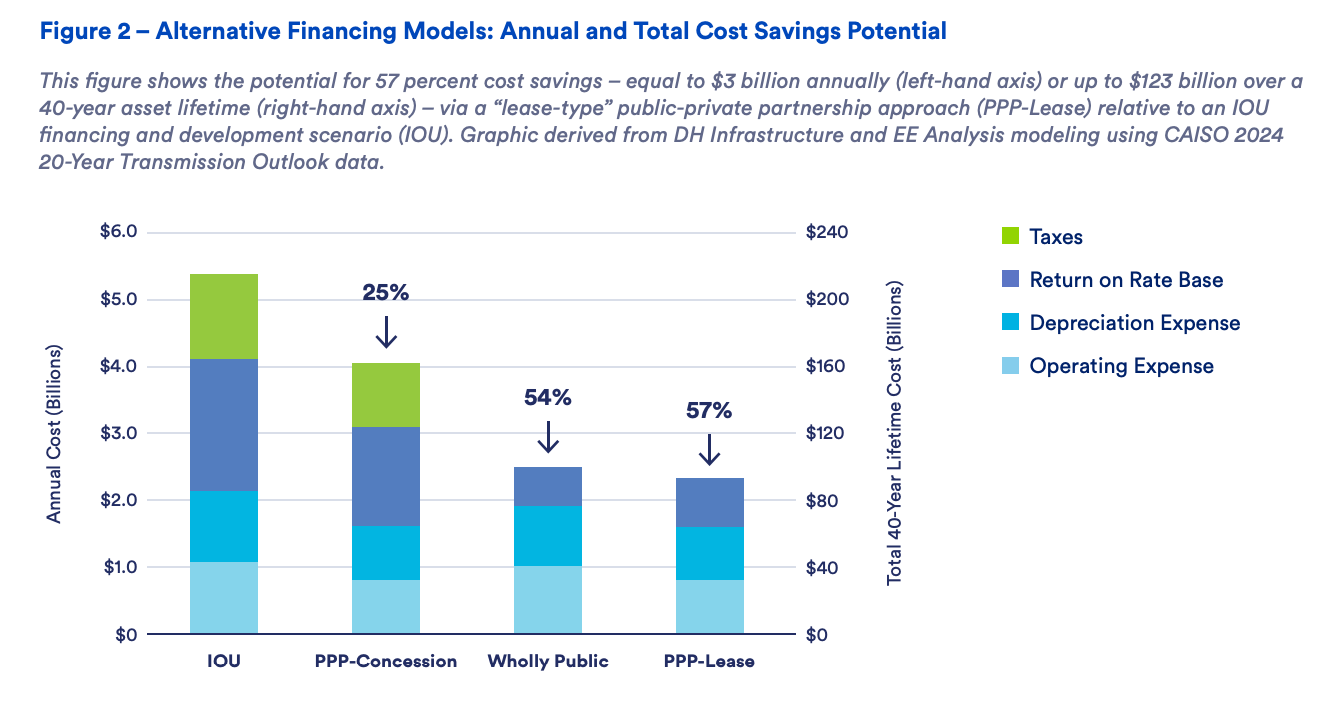

California-based Clean Air Task Force (CATF) and Net Zero California (NZC) have released new analysis showing that public-private financing models could save Californians up to $3 billion annually in transmission infrastructure costs.

The analysis has evaluated four different financing approaches:

traditional investor-owned utility (IOU) financing - IOU develops, finances and operates the transmission lines

wholly public approach - government builds, finances, operates

concession-type public-private partnership - the BOOT (build-own-operate-transfer model) where a private entity builds, operates and finances the asset and transfers it to the government at the end of the concession period

lease-type public-private partnership - a government-owned holding company or special purpose vehicle finances the asset, and a private entity operates it

It finds that the 'lease-type' public-private partnership model offers the most cost-effective approach, followed by a wholly public model.

The California Independent System Operator (CAISO) has identified a need for $46-63 billion in new high-voltage transmission infrastructure investments to achieve its 2045 clean energy grid goals. The analysis by CATF finds that that leveraging public sector financing could reduce transmission financing and development costs in California by up to 57%, equivalent to $123 billion over 40 years.

Potential cost-saving strategies include - financing transmission projects through low-cost public debt, and reducing risk through predictable siting and permitting processes. The organizations have released a companion national-level policy brief to help other states and regions implement similar financing models.

UK government-backed pilots to decarbonize homes

In 2022, the UK’s Department of Net Zero and Energy Security launched the Green Home Finance Accelerator to fund “the development and piloting of green finance products that enable the uptake of home energy efficiency, low carbon heat, and micro-generation measures in the non-fuel poor sector.”

The program awarded £4,169M in grant funding to 26 projects during its 6-month Discovery Phase, followed by £15,370M to 13 selected projects for market pilots until March 2025.

Two key initiatives have emerged from the program:

Scroll Finance is offering second mortgages specifically for green home improvements,

Perenna is implementing a 0.2% interest rate reduction for homeowners who install renewable energy technology.

The program has also revealed through research conducted by Chameleon, People Powered Retrofit (PPR), and Snugg that key motivators for green home retrofits include energy bill savings, improved home comfort, and environmental concerns.

It found that young parents, empty nesters, and 'forever home' buyers are the primary target demographics.

More case studies from the GHFA

Catch up on COP29

New Collective Quantified Goal on Climate Finance;

Global Carbon Market;

Country Announcements and NDCs;

Fossil Fuels;

Hydrogen, Green Digital Action, Climate-Friendly Tourism, Pumped Storage