Climate Finance Roundup December 18

Ecuador Debt Conversion; Australia green iron project; UK to align sustainability reporting with IFRS; Funding for RE, battery manufacturing, energy infra

In this newsletter

Ecuador closes debt conversion, will fund Amazon restoration

Australia funds Green Iron project

UK to align sustainability reporting with IFRS standards

EU voluntary sustainability reports standards for non-listed SMEs

Renaming funds as per ESMA sustainability guidelines

Funding Announcements - PG&E, BlueOval, UPP, Sonnedix

More Climate Finance News here

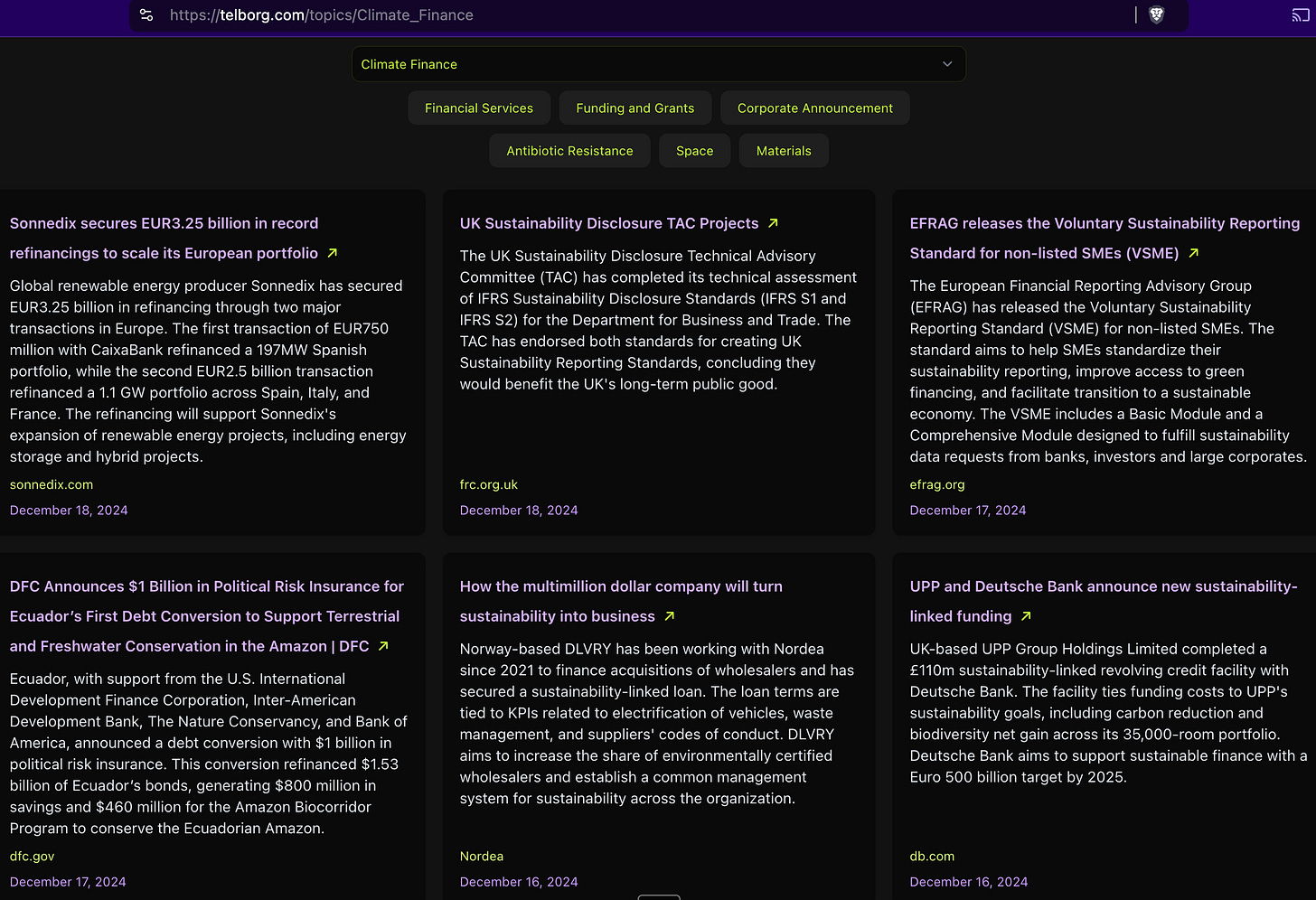

Ecuador closes debt conversion, will fund Amazon restoration

Ecuador has announced a $1.53 billion debt conversion deal supported by $1 billion in political risk insurance from the U.S. International Development Finance Corporation (DFC). The transaction will generate over $800 million in fiscal savings for Ecuador by 2035 and unlock approximately $460 million to support the Amazon Biocorridor Program for conservation of terrestrial and freshwater ecosystems in the Ecuadorian Amazon, involving partners including the Inter-American Development Bank, The Nature Conservancy, and Bank of America. dfc.gov

Australia funds Green Iron project

Australia's largest iron ore miners BHP and Rio Tinto, along with steelmaker BlueScope, have selected Kwinana Industrial Area near Perth for developing Australia's largest ironmaking electric smelting furnace (ESF) pilot plant. The NeoSmelt project, joined by Woodside Energy as an equity participant and energy supplier, will produce 30,000-40,000 tonnes of molten iron annually using DRI-ESF technology, supported by A$75 million from the Western Australian Government, with operations expected to begin in 2028. bhp.com

UK to align sustainability reporting with IFRS standards

The UK Sustainability Disclosure Technical Advisory Committee (TAC) has completed its technical assessment of IFRS Sustainability Disclosure Standards (IFRS S1 and IFRS S2) for the Department for Business and Trade. The TAC has endorsed both standards for creating UK Sustainability Reporting Standards, concluding they would benefit the UK's long-term public good. frc.org.uk

EU voluntary sustainability reports standards for non-listed SMEs

The European Financial Reporting Advisory Group (EFRAG) has released the Voluntary Sustainability Reporting Standard (VSME) for non-listed SMEs. The standard aims to help SMEs standardize their sustainability reporting, improve access to green financing, and facilitate transition to a sustainable economy. The VSME includes a Basic Module and a Comprehensive Module designed to fulfill sustainability data requests from banks, investors and large corporates. efrag.org

Renaming funds as per ESMA sustainability guidelines

France's Autorité des Marchés Finances has decided to apply the European Securities and Markets Authority's Guidelines on funds' names, which include ESG or sustainability-related terms. These guidelines, effective from 21 November 2024 for new funds, will be applicable from 21 May for existing funds. The guidelines allow funds with environment-related names to invest in European Green Bonds or other green bonds financing green activities. AMF France

Funding Announcements

US-based PG&E received a conditional commitment from the U.S. Department of Energy for a loan guarantee of up to $15 billion. This financing aims to enhance California's energy infrastructure, support distributed energy resources, and potentially save customers up to $1 billion. Projects include retooling hydroelectric power, increasing battery storage, and expanding transmission systems. pge.com

US-based SK Innovation, SK On, and SK Battery America secured a $9.63 billion loan from the U.S. Department of Energy for BlueOval SK, a joint venture with Ford Motor Company, to construct three battery manufacturing plants in Tennessee and Kentucky, enabling up to 120 gigawatt hours of battery production annually. cov.com

UK-based UPP Group Holdings Limited completed a £110m sustainability-linked revolving credit facility with Deutsche Bank. The facility ties funding costs to UPP's sustainability goals, including carbon reduction and biodiversity net gain across its 35,000-room portfolio. Deutsche Bank aims to support sustainable finance with a Euro 500 billion target by 2025. db.com

Global renewable energy producer Sonnedix has secured EUR3.25 billion in refinancing through two major transactions in Europe. The first transaction of EUR750 million with CaixaBank refinanced a 197MW Spanish portfolio, while the second EUR2.5 billion transaction refinanced a 1.1 GW portfolio across Spain, Italy, and France. The refinancing will support Sonnedix's expansion of renewable energy projects, including energy storage and hybrid projects. sonnedix.com

Consolidated by Soumya Gupta (Twitter, LinkedIn).